Life is as simple as a Rugosa Rose!

This post was first submitted to a site that targets the investment community. It is a site that sought me out through multiple persons. I did not understand why the site is interested in what I have to say since it appeared on the surface to be focused on new tech, but on deeper inspection, it is about about more than that. However every venue has its parameters, which I respect.

Beyond that is the larger context of a new media world that gives voice to a greater range of perspectives and voices than we have ever seen before with many venues are calling for research, history, and most importantly personal stories and that is exactly what I do.

As a writer, one gets a sense when one is pushing the boundaries of a venue. I know that the investment community are the beneficiaries of the status quo that I am challenging, but on the other hand I am listening and responding to the louder chorus of voices, particular the younger generation because in the long range, the future is theirs. I read many stories about the generational history of families from all walks of life. One of the common themes is the wealth divide which has been escalating since the 1970’s. My parents started a business with a mission to “create a hand crafted product affordable to the middle classes” That was during the golden era of the middle classes when plastics were taking over the market. That simple idea expresses a social and political belief system.

So I was not surprised when I received a response from the website asking if I could rewrite the story, “It would be great if you could soften it with less constitution-themed wordings, less specific to a locality / regional operational context, and double down on making a philosophical observation or suggesting a policy implication. and it is also much longer than the optimal length (which is anywhere between 800 and 1200 words). Your draft contains quite a bit of quoted texts from legal proceedings which augmented the length tremendously. Would you be able to make some changes in the suggested direction?

That is a nice way of saying we like how you think but not what you write about, for their audience. I did not take offense to it. I understand that I am advocating changes in policy that currently benefit the investment class, Off course there will be push back. I like the person who wrote this and I feel that he is a bridge between myself and others on the board of the site. I can use this dialogue in my screen play if I ever get around to writing it. In my screen play both characters understand perfectly what is being asked and both characters are on the same side. and so I responded with “I would consider writing an article like that.In this article I wanted to document a specific history that actually occurred as no one else is likely to do so,

so I will just withdraw this article and submit another one in a while.” and it is true that I will do that. I have programmed it into the navigation software that runs in the background of my mind.

But in the here and now, I submitted this story to another Medium publication, Illumination, and it is generating many new followers including some from the investment community.

In terms of length, this story is as long as it needs to be because it is a comparison of four interrelated stories. I could have made it four shorter stories but then the interrelationship between the four stories would not be as apparent, and that is one of the primary subjects of the story. Here it is:

Under Maine’s Progressive Governors, Creeping Corporatism Grew the Wealth Divide

Today I woke contemplating an idea I spoke about planned residential dwelling units at First Park, the three million dollar project of rural lands transformed into a development corporation by the Maine Legislature in 1998.

I wondered how a residence would create the jobs promised by the promoters of the development corporation, unless zoned as businesses in residence, an idea whose time is waiting to happen.

After twenty years Municipalities Incorporated was far away from the 3000 jobs promised to materialize from a business park built in the rural meadowlands.

The business park is one of those ideas that is popular despite its inappropriateness to a location, like the mini-round-about placed in the unobstructed main throughway in my home town, requiring another road to be inconveniently rerouted to give the appearance that there was a functional purpose in placing a roundabout in the middle of the most travelled road in town. Praise Be to the landscape in the middle of the road, is it an automobile gliding rink?, is it a God?, or is it just an obstacle in the middle of the road?

There is no rational other than fantasies of financial windfalls for a business park to be arbitrarily placed in a rural region. The equivalent cost could be spent on each municipality supporting its own region.

The contextual infrastructure of a business park is that of a commuting culture expanding amid increasing concerns that global warming may be caused by carbon emissions.

The economic model is to concentrate the wealth of an entire region or state to build up the economy in small targeted hot spots.

Inevitably this leads to underserved communities of the region wanting out and powerful oligarchs preventing their exit.

Why would a business prefer a public location in artificially developed surroundings over the private natural surroundings found through out a rural region? other than zoning? If a business is large enough, and rich enough, and tuff enuff, community leaders will give it all the love it wants, with or without a lawsuit.

If the business has a reason to be in proximity to other businesses, there is an old fashioned concept called a town that might work. The rural business park is urbanism imposing its own values over rural sensibilities, as if one should insert full blown city blocks into the countryside. Why? Why not let the country side be the countryside, accommodating human activity in a more relaxed style? Rural living is an graceful choice if one is fortunate enough to have such an opportunity, so why would those so fortunate desire to remake themselves as city and surrounding suburbs of commuters?

At the turn of the century, these thoughts were not on the minds of Maine’s ruling class of constitutional progressives as they made plans prohibited by the words and intent of the Maine Constitution, the word and intent of the law being the definition of constitutional originalism, as Senator, Angus King, former Governor at the turn of the century, recently riled against in an opinion published in the Atlantic.

Four City-States Chartered During the King and Baldacci Governorships

Maine has four city-state corporations that I know of. One is the Kennebec Regional Development Authority and the other three are former navy bases repurposed for civilian use, but not by the political ideology that founded the United States and Maine. It is tragically ironic that bases that were used to defend the nation against advancing totalitarianism have been transformed into the instruments for creeping totalitarianism.

There was a purpose in addressing the loss of military jobs in creating business parks at the three base closures, but the essential vulnerability inherent to reliance on large employers is amplified in the policies of central management which routinely seeks to solve problems in large brushstrokes, while dismissing the benefits of diversified opportunity across the entire economy within an incremental scaling of economic strata.

Maine Constitutional Progressivism Leads the Way in Repurposing Former Military Bases

In 1994, Loring Air Force Base was the first former military base to be closed and then transformed by the Maine Legislature into a “municipal corporation serving as an instrument of the state”, aka a “quasi-public-agency”.

In How Regions Adjust to Base Closings: The Case of Loring AFB Ten Years After Closure, 2005 . a Maine Center for Workforce Research and Information document, The term “a quasi-public agency”, masks the fact that a “municipal corporation serving as an instrument of the state” is arguably in violation of Article IV Part Third, Section 14, of The Maine Constitution, and also defies the standard legal definition of a municipal corporation as an instrument of municipal government, and not an instrument of a state government:

As an “authority,” the LDA is a quasi-public agency with jurisdiction over a public resource, in this case, the base property that became the Loring Commerce Centre. The LDA acts as a municipality and a corporation, but without the ability to levy property taxes. How Regions Adjust to Base Closings: The Case of Loring AFB Ten Years After Closure, 2005

Legal Definition of Municipal Corporation by Cornell Law School

A city, town, village, or county that has been incorporated by a state and is authorized to administer local, governmental affairs, e.g. to establish a police force. A municipal corporation is created by a state’s legislature which also controls, inter alia, its duration, rights, and powers. Also called a municipality. Cornell Law School

Section 14. Corporations, formed under general laws. Corporations shall be formed under general laws, and shall not be created by special Acts of the Legislature, except for municipal purposes, and in cases where the objects of the corporation cannot otherwise be attained; and, however formed, they shall forever be subject to the general laws of the State.

That said, How Regions Adjust to Base Closings: The Case of Loring AFB Ten Years After Closure, 2005 instills confidence in the integrity of management in its straight forward transparency and attention to detail as it relays in unapologetic honesty how wealth redistribution and corporate welfare was utilized to make the transfer to civilian use a relatively smooth one after environmental clean up was addressed, and handled by the federal government.

Today the Loring Center website refers businesses to local economic development groups to learn about available incentives supporting a protocol that treats the wider culture equitably, as is possible, relative to a development authority designated, at one point, at least, as a Pine Tree Zone.

The character of businesses located at the authority blend into the rural Maine culture, giving substance to the development’s decision to call itself a “center” as opposed to an “authority”. For these reasons, I rate the Loring Commerce Center as the most successful city-states despite the Midcoast Regional Redevelopment Authority boasting over 2000 jobs to the Loring Center’s 1200. Midcoast advertises its corporate welfare incentives far too aggressively as it stands on the brink of possibly losing a central core of Maine corporate welfare if the Pine Tree Zone is repealed at the end of 2021.

The Loring Air Force Base was located in Aroostook County in northernmost Maine. According to the report, 62 percent of the base area is in Limestone, another 32 percent is in Caswell, and the remaining 6 percent is in Caribou.

Today Limestone is a designated opportunity zone, pursuant to the Federal Tax Cuts and Jobs Act of 2017.

The transference to civilian use of the Loring Air Force Base, in Maine’s third poorest county, makes for an interesting comparison with the Midcoast Regional Redevelopment Authority, in Maine’s wealthiest county. Loring also provides a stark contrast with the handling of the transference of Cutler Navy Base in Washington County, northern Maine’s poorest county, while the comparison of The Kennebec Regional Development Authority in Maine’s seventh wealthiest county, in close proximity to the Midcoast Regional Redevelopment Authority in Maine’s wealthiest county, underscores the unfair advantage the Pine Tree Zones confers on the chosen locations over every where else.

A reason for the more legitimately planned transference of the Loring Base, rather than the shady hand dealt the Cutler Navy Base, is accountable, in part, to the degree of environmental clean up required by the former Loring Air Force Base, preventing the possibility of external parties swooping in to grab the real estate interests. The federal government was needed to finance the environmental clean-up at the air force bases.

The Fate of the Authority in Maine’s Poorest County

|

| rachel-c-unsplash |

The redevelopment of Loring, was strategically planned and involved massive amounts of federal and state aid, while the transference of the real estate properties at Cutler Navy Base was a fly by night operation, arranged by a special congressional delegation to the Navy, and the Maine State Legislature, which left the base without assets or local authority to raise revenue through property taxes.

A significant difference in the fates of WCRA and Loring is the way that expensive-to maintain military property was handled. In the case of Loring:

As it began its work, the Loring Development Authority recognized that something needed to be done to keep the base from deteriorating. The State of Maine could not afford the millions of dollars needed to protect and maintain the buildings on the base. The Authority and Maine’s politicians lobbied for federal assistance. Loring pioneered a 10-year caretaker agreement with the Air Force. The base went into “caretaker status” after residual operations phased out with its subsequent closure. Caretaker status meant federally-funded security and limited maintenance to keep base facilities in “mothballed” condition. How Regions Adjust to Base Closings: The Case of Loring AFB Ten Years After Closure, 2005

Federal base closure rules qualify economic development organizations “in one form or another” to present proposals for the use of the base. It is possible to obtain the property for no or very little cost. The main stipulations for that opportunity is that proceeds of sales or rental of property be used for economic development at the former installation and that public agencies or private non-profits provide vital public services such as education, health care, homeless services, parks and recreation, law enforcement, prisons, self-help housing and transportation.

The Maine Legislature got around the requirement that proceeds of real estate revenue be invested in the former base located in Cutler, Maine, by first chartering the base as a municipal corporation serving as an instrument of the State. In accordance with DOD rules, the Washington County Redevelopment Authority was to serve as an economic development instrument of conveyance from the DOD, but the economic development of the base was clobbered by what happened next.

Based on history to date, it is reasonable to conclude that The Washington County Development Authority was created solely for the purpose of receiving the property from the federal government and then giving it to a newly created private non-profit, Cutler Development Corporation, which in turn sold the real estate to a private developer and the proceeds were split by the surrounding towns and nothing was invested in the base, which was then promptly forgotten about by the Maine Legislature which still claims the Authority as its instrument.

According to hearsay, the WCRA gave the real estate to the non-profit Cutler Development Corporation. If the Cutler Development Corporation had purchased the property from the Navy, it would have been required to pay fair market value as the corporation did not meet the requirements for a no-cost conveyance. If WCRA had sold the real estate to the Cutler Development Corporation, it would have been required to invest the proceeds in the base, but a gift is not a sale and so there were no proceeds required to be invested in the base.

In an economic development model that inverts conventional wisdom, the combined actions of the Authority and the corporation depleted the base of capital resources needed for development.

Instead of investing concentrated wealth in the economic development zone on the theory that it will trickle down to benefit the surrounding region, in the Cutler case, its resources were taken out from under in order to sell the real estate and distribute the cash among the towns of the surrounding region, without involving a job-creation initiative. The well considered report on the Loring Base explains how the loss of military jobs affects an entire region. Was Cutler an exception? Were there no job lost in the closure of the Cutler Navy Base? Why was the instrument of conveyance used to transfer military property to civilian use left with fewer financial resources than a conventional municipality has to maintain and develop its assets?

A Tale of Two City-States

In contrast the Loring Development Authority was the agent that sold the real estate to private businesses, re-investing the proceeds in the base.

In July 2001, the Air Force transferred 2,805 acres out of a total 12,000 acres of base property to the LDA at no cost through an economic development conveyance….The Loring transfer, besides being the largest military base transfer at the time, allowed the LDA to sell the property to businesses instead of leasing it, as it had been doing. The remaining 21 acres were transferred to the U.S. Fish and Wildlife Service to establish the Aroostook National Wildlife Refuge. How Regions Adjust to Base Closings: The Case of Loring AFB Ten Years After Closure, 2005.

A View from Sunrise County Economic Council

In 2015, I was aware that BRAC closure rules gave first priority to local organizations and so I wrote to the Sunrise County Economic Council and asked this question: “When the Cutler military base closed down did any of the economic development organizations in Washington County bid on it or was the state the only one? I received this answer:

The Cutler Base closure was a very interesting process. Because of the usual transition of surplus military property (if I remember correctly it is other branches of service first, then federal government, state government, local government, then other organizations), the State created the Washington County Development Authority (WCDA; a quasi-governmental agency) as a local entity who could receive the property directly from the military The WCDA was able to then give the property to the Cutler Development Corporation (CDC) which was a local development corporation created to assist the town and local area with dealing with the issues caused by a base closure. The CDC sold the property to a developer and the bulk of the funds from the sale were shared between the towns that made up the CDC.

There have been issues at the base, and development has not gone as planned. The base has two segments — commercial and residential. The commercial side has recently been granted back to the WCDA and they are considering options for possible reuse of facilities.

My correspondent did not remember correctly, or else she was not informed correctly. The following is from the Military Base Reuse Handbook:

The community in the vicinity of an installation is defined as the political jurisdiction(s), other than the State, that comprise the LRA for the installation. If no LRA is formed at the local level and the State is serving in that capacity, then the community in the vicinity of the installation is deemed to be the political jurisdiction(s) in which the installation is located.

Public agencies and private nonprofit organizations

Public agencies and private non-profit organizations are often eligible for one of several public benefit conveyance programs that make surplus properties available at up to a 100-percent discount of fair market value. Surplus military property may be conveyed to these public agencies and private non-profits to provide vital public services such as education, health care, homeless services, parks and recreation, law enforcement, prisons, self-help housing and transportation.[1]

[1] https://www.hudexchange.info/resources/documents/MilitaryBaseReuse.pdf

On the other hand my correspondent was correct as specially negotiated rules were arranged for the Cutler Base by the powerfully connected .

A Trip to Washington to Change the Rules

In 2000 The Bangor Daily News reported that Senator Olympia Snowe supported by Maine’s Congressional Delegation introduced federal legislation to transfer two hundred sixty acres of coastal real estate including 22 administration buildings, 61 units of base housing, and a variety of recreational facilities, garages, a concrete dam and a freshwater reservoir that the Navy no longer needed to a local reuse authority composed of the towns of Cutler, East Machias, Machias, and Machiasport.

The BDN article is no longer available on line. However at the time I read the article in 2015 I thought that what occurred was not being reported accurately. The articles of incorporation of the Cutler Development Corporation can be downloaded from the Secretary of State website. Cutler selectman, David Eldrige and Machias selectman, Kenneth Bucket Davis were the two incorporators, listed as private individuals without mention of an official relationship to the towns.

Maine’s congressional delegation to Washington D.C. included Senator Olympia Snowe (R), Senator Susan Collins (R), and Representatives John Baldacci (D) and David Allen(D), who met with Navy Secretary Richard Danzig to discuss plans for the Cutler Naval Base. Danzig assured the delegation that he made the final call on whether the Navy will transfer all military personnel from Cutler.

The Secretary of the Navy is subordinate to the Secretary of Defense. BRAC Base Closure Rules grant authority to the Secretary of Defense to transfer real property and personal property to the redevelopment authority for consideration at or below the fair market value. A reduced or no cost conveyance can be authorized when it is determined to be necessary to support economic development and when DOD could show that other transfer authorities were insufficient. The Washington County Redevelopment Authority was the instrument of conveyance, supposedly under the rubric of economic development.

The delegate to Washington negotiated a special act of legislation H.R.4205 — Floyd D. Spence National Defense Authorization Act for Fiscal Year 2000, which authorized the conveyance of the Cutler Military Base to civilian use, changing the priority for instruments of conveyance.

General BRAC closure rules grant priority to local economic development conveyances (EDC). H.R.4205 — Floyd D. Spence National Defense Authorization Act for Fiscal Year 2000 allows for the property to be conveyed to “to the State of Maine, or a subdivision or agency thereof”, changing the priority of transfer conveyance from a local authority to a state authority and from any type of organization to a government organization.

The Washington County Development Authority was left without assets and as an instrument of the state it lacks the authority to collect property taxes. The statute authorizes the base to raise money through issuing bonds but as the Authority is an instrument of the state, it must have the bonds issued through the state, and so what is said about it is really quite confusing since the media never mentions its statutory status.

In 2014 the expensive to maintain commercial property was given back to the base by a private developer, As written in WASHINGTON COUNTY ANNUAL REPORT July 1, 2014-June 30,2015, The volunteer board of WCRA petitioned the Legislature for a bond to maintain the property and develop the base and the Legislature shelved the request to the next session.

No further news was found until this story in February 2020. There is at least one business at the Washington County Redevelopment Authority and the owner seems very gung-ho. The business is over one hundred years old. I am glad the Authority has found one so enthusiastic.

Timeline of Four Corporations Chartered by Special Acts of Maine Legislation 1998–2005

Because of the complexities involved with environmental clean up and other federal involvement, the transformation of Loring took a longer time between base closure and the establishment of a commerce park, which happened gradually throughout the time that the KRDA and the Washington County Redevelopment Authority were chartered as corporations by the Maine Legislature.

Kennebec Regional Development Authority, was chartered by the Maine Legislature in 1998, hosting the first business park, aptly named First Park. It is the only business park that is not chartered as an instrument of the state, instead the region of municipalities have become the instruments of KRDA”s corporate board, thanks to an act of the Maine Legislature.

Washington County Redevelopment Authority was chartered in 2001 in the state’s poorest county, coincidentally around the same time that property was being transferred to The Loring Redevelopment Authority, using a starkly different method of transfer.

Midcoast Regional Redevelopment Authority was chartered in 2005 in Maine’s wealthiest county.

In part, the proliferation of business parks is due to the command economy’s preference for targeted sectors. Maine’s arguably most successful city-state, the Midcoast Regional Redevelopment Authority has its own targeted sector of industries, a phenomena which occurs on its own in a free enterprise economy as businesses gravitate to clusters of other businesses supportive of their own economy. A free enterprise economy does not need oligarchs to impose artificial divisions, nature creates a diversified mix serving subtleties of human culture that command central cannot accommodate and does not recognize, as in general, the centrally managed economy fails to recognize the existence of that which it does not manage.

As a designated Pine Tree Zone, tax payer subsidized by the entire state, MRRA has an unfair advantage over other business parks, excluding Loring which is stated as being a Pine Tree Zone in How Regions Adjust to Base Closings: The Case of Loring AFB Ten Years After Closure, 2005, though currently not identified as such on its website.

First Park is taxpayer subsidized by a region of municipalities and does not list corporate welfare benefits specific to First Park, where as MRRA has an extensive menu of incentives specific to MRRA.

The Pine Tree Zones were enacted in Maine around 2003 as a program for low income high unemployment areas, but four years later, with little media fanfare, PTZ’s expanded to state wide locations to be designated by the central managers of Maine’s economy.

On March 19, 2013, Mr. Douglas Ray, legislative liaison for the Department of Economic and Community Development testified before The Joint Standing Committee on Labor, Commerce, Research, and Economic Development

Of the 390 or so businesses participating in the Pine Tree Development Zone Program a vast majority, more than 300 are manufacturers, that’s roughly 80%. These businesses have pledged almost a billion dollars in investment and anticipated payroll of nearly $850 million and 74 hundred jobs.

The average wage calculated on Mr. Ray’s figures is $114,864 annually, more than three times the median income in Maine in 2013, and yet the MRRA is both a designated Pine Tree Zone and a designated opportunity zone, which targets high unemployment, low income areas. pursuant to the Federal Tax Cuts and Jobs Act of 2017 .

I can only speculate on how it can be that a zone that boasts the highest income in Maine can also be designated a low income opportunity zone. It might have to do with designating income tracts by family incomes. Former military bases include residential units but non-residents employed in highly paid Pine Tree Zone jobs are (speculatively) counted as residents in different tracts.

a. Eligible tracts.

The definition of an LIC under the quantitative limits on QOZs and non-LIC contiguous tracts is similar to the definition under section 45D(e)(1) for NMTCs: any population census tract if (1) the poverty rate of the tract is at least 20 percent or (2) the median family income for the tract does not exceed 80 percent of statewide median income, or, for a metropolitan census tract, 80 percent of the metropolitan area median family income if greater than the statewide median. 107 A non-LIC tract may be designated if it is contiguous to an LIC that has been nominated as a QOZ by a state (including a different state), and if median family income for the tract does not exceed 125 percent of the median family income for the contiguous LIC tract.108 However, no more than 5 percent of a state’s QOZ designations can be allocated to non-LIC tracts.

|

| designecologist-unsplash |

And there is this:

BRUNSWICK — A new development of three dozen single-family homes at Brunswick Landing could bring some much needed “affordable” and workforce housing to the area.

Shipyard Ventures, or Brunswick Landing Ventures, is developing 36 single-family residential lots on Neptune Drive, Forrestal Drive, Intrepid Street and Guadalcanal Street in Brunswick Landing, the former Brunswick Naval Air Station. Portland Press Herald August 19 2020

Low income opportunity zones are determined by median family income within the tract. Affordable housing located in a business park that negotiates corporate welfare for upper income jobs can serve to qualify the tract as a low income zone, the more so if the affordable housing is rental units, assuring, in compliance with the IRS Safe Harbor Act, that the income of residents will not significantly increase as the Safe Harbor Act requires landlords to designate rental units per income brackets permitting very little room for economic growth.

MRRA is facing the possibility that the Pine Tree Zones might be repealed at the end of 2121. Low income housing in a high income business park can serve to preserve its subsidies needed to attract the high income employer. It’s an odd recipe for economic integration, especially if the Major Headquarters Expansion Act is factored in.

The Major Headquarters Expansion Act is based on the Pine Tree Zone Tax exemptions reinvented for national or global corporations hiring at least 1250 employees at higher than average wages and benefits. It was concocted by Governor LePage during the season of the Amazon Headquarters contest, and passed with barely a media mention.

Imagine the evolution of the town of MRRA as a municipal corporation featuring low income rental housing and high income global corporate employees who commute from other regions, while also serving as the capital center of the public-private corporate state of Maine, kind of like a Silicon Valley of houses made of ticky tacky that all look just the same with the corporate state kingdom court in the mix.

MMRA is the unofficial hob nob central of central management which includes The Maine Technology Institute, The Department of Economic and Community Development, The University of Maine, Tech Place, Southern Maine Community College and other regional organizations, a golf course and an airport. You might say it is the campus of Maine State Inc.

As a highly subsidized campus, it is possibly as dependent on the subsidies that the Pine Tree Zone tax exemptions enable, as the region was once dependent on the Air Force Base.

It is, of course, speculation on my part that affordable housing is needed to keep the base in its subsidies, if the Pine Tree Zone should be repealed, but my speculation is not out of character with they way special interests have been innovatively adapting many programs in Maine, the fate of the Cutler Navy Base, being a case in point.

Most economic development thinking fails to take the psychological cultural environment into consideration, but it is something that powerfully affects the individual’s sense of well being and belonging in the world. I grew up in Boothbay where the stakes of cultural walls separate the year round local community with very long roots, an equally long rooted summer community, and new, mostly well-to do transplants with time on their hands. From one Maine culture to another, one can extrapolate how the cultural mix at MRRA can potentially evolve into an upstairs downstairs community rife with self esteem issues among all levels of the populous.

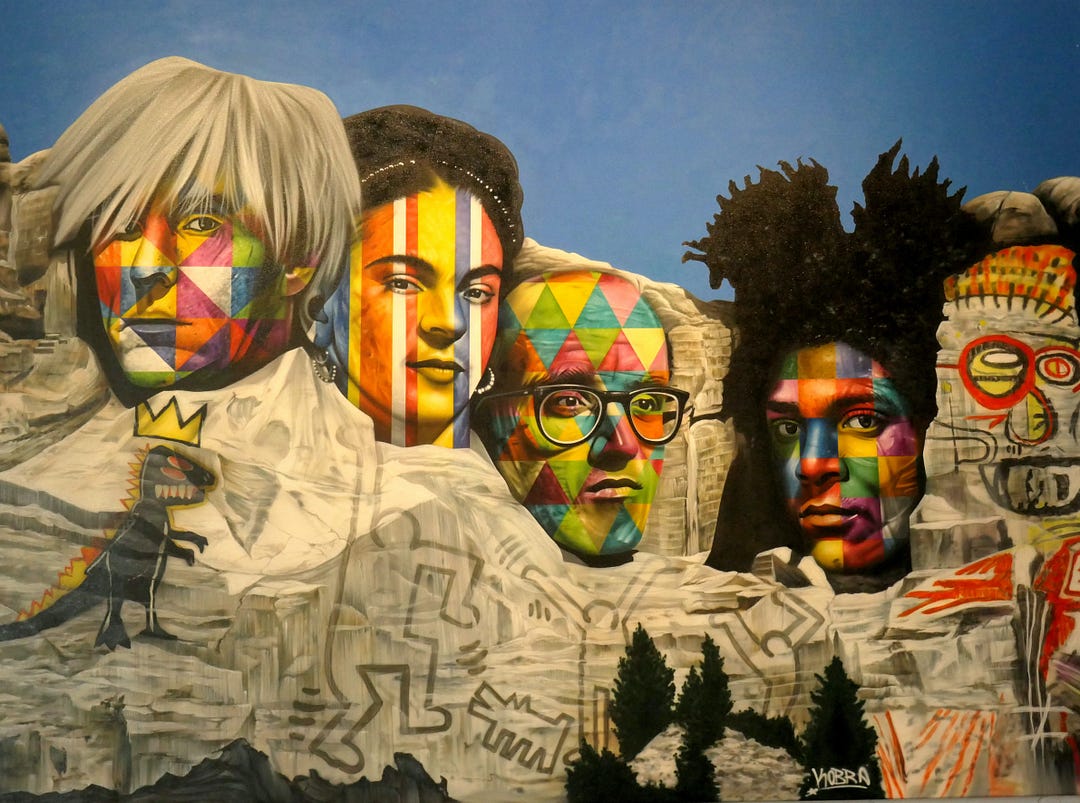

Glaringly missing in this picture is the middle. It’s time to give voice to a new middle. Who is it? Where is it? What is it? And How is it? And Why do we need it?

Is an Alternate Movement Viable ?

As I indulged in my morning meditation fantasies, the thought of First Park’s proximity to MRRA, the core of central management’s inescapable network, sparked an image of two contrasting cultures representing top down competing with roots up, except for the minor detail that First Park and the entire region of twenty four municipalities is a regional development corporation, not a promising scenario for autonomy. Still the essential contrast is dynamically representative of the command economy vs the free enterprise economy, a confrontation taking place on a global scale. How hip is that, in a state so obsessed with being “world class”?

The ideal location for the alternate economy, zoned for businesses in residence, is in a town having its own charter pursuant to the Home Rule Amendment. While a town charter is not essential, it clearly establishes that the town is the local authority, as opposed to having state and regional organizations govern the town, as is the case with the city-states.

The progressive business parks are the full blossoming of seeds planted by the federal government in 1968 with enactment of The United States Intergovernmental Cooperation Act of 1968, Public Law 90–577, an act which uses wealth redistribution to encourage states and municipalities to change constitutions and ordinances to conform with federal management of the Union’s economy.

The Home Rule Amendment was added to the Maine Constitution in 1969, a year after the federal congress passed The United States Intergovernmental Cooperation Act of 1968, Public Law 90–577 and seven years before the Maine Legislature deemed Maine to be a centrally managed economy during the Longley administration. Local governance, granted by the Home Rule Amendment, is ideologically opposed to that of central management

Today we are in a time of significant change. In Maine, the new spikes in corona virus has not yet slowed down the real estate boom. Maine is experiencing a migration into the state that may equal past out-of-the-state migrations during eras of major industrial change.

The following words said about base closings equally applies to this current time of change and transformation:

Furthermore, base closings underline a more common theme for all communities. Communities must recognize that economies have limited lives and that the success of a community depends on its ability to recognize economic lifecycles.

…..Closure announcements should not be met with panic and fears of “doom and gloom.” Rather, they should be seen as opportunities to shed the old in place of the new, which ultimately lead to innovation, production, and growth.

How Regions Adjust to Base Closings: The case of Loring AFB ten years after closure

As the state controlled economy has become more deeply entrenched over the years, I have noticed a hierarchical attitude creep into the cultural norms as those occupying positions in government or non-profit organizations manifest an attitude of authority over anyone’s choices about anything in an inordinate manner, by constitutional standards.

The existence of a hierarchy of power, imagined or otherwise, marks a distinctive difference between the cultural character of a command economy and a free enterprise economy in which there is a wide distribution of interacting hierarchies based on diverse cultural values.

Business in Residence -an Expansion on the Artist in Residence

In searching for a location to invest our unusual assets, my instincts tell me that municipalities chartered as instruments of the state are a must to avoid. The configuration at KRDA requires that local property taxes subsidize the business and development at First Park. That means that small businesses located in municipalities in the KRDA region add another layer of taxation to the federal and state taxes used to subsidize larger industries.

The possible exception is the Washington County Redevelopment Authority, as it is ignored by the Maine Legislature, but WCRA would need to reclaim its constitutional municipal autonomy first- and why don’t they? What has being an instrument of the state ever done for them, other than rob the base of its real estate assets and its ability to levy property taxes?

All the legislation needed is that required by the Home Rule Amendment to the Maine Constitution, to prescribe the procedure by which the municipality may so act to amend its own charter. Then the municipality can repeal the words that say it is an instrumentality of the State and become a town, like any other town.

|

| So There ! Photo by patrick-pettitt-unsplash |

If Maine is ever going to reverse centralization, which has only expanded the wealth gap since it was instituted in 1976, a repeal of the Pine Tree Zones can be a significant advance, by preventing the Pine Tree Zone tax exemptions from being used as an instrument to transform refundable tax credits such as the Seed Capital Tax Credit, into a 50% subsidy cost passed on to the working class and the lower end of the ownership class, to capitalize of the upper end of the ownership class. In a time when Marxism is still a voice heard around the world, job creation is marketed as justification for the workers to finance the ownership, by the elite classes, of the means of production. How did we get from there to here?

Businesses in residence support the lower to upper ownership class as an individualized opportunity zone. Typically in my local region, town ordinances restrict the number of employees allowed for businesses in the home to two non-family-member-employees, functioning as yet another means to cap economic growth at the roots of the economy. No wonder the wealth divide keeps expanding! If such ordinances existed when my parents were growing their business, they would have had to move to a different location to avoid having their growth nipped in the bud by town leadership.

The ordinances allow artists to have a gallery but the artist is only allowed to show their own work. My mother went to the gift shows and brought back many interesting objects to sell, receiving awards for her retailing talent, but today such creativity is a violation of Boothbay town ordinances. written by those who have moved into the area more recently. We are experiencing a new migration into our communities. What changes will this new migration bring about? The local real estate market is booming from the bottom to the top of the market. What does this tell us?

In a natural economy, there is no reason to cap the numbers of employees for businesses in residence, any more than there is a need to cap the number of family or friends, or maintenance workers who are allowed to congregate at a location, because that number is limited by the physical space on the premises. If a business outgrows it space, it looks for another space, rather than packing its employees in like sardines. These ordinances are designed to cap economic growth at the roots of the economy, and to eliminate a quality rural lifestyle.

There is a justifiable purpose served by current affordable housing caps on the income growth of its occupants, which is to insure that affordable housing is always available for those most in need, but in an era in which there is an ever widening income gap, there needs to be attention paid to the availability of accessible pathways to increasing financial status throughout economic strata.

Business in residence zoning, supported by financial assistance programs. function as individualized opportunity zones. Persons owning their own business develop opportunities for themselves and others using their own skills and talents and that of their teams. The ability to combine home and work has all kinds of advantages, including economic advantages.

Remote working introduces a potential shift in cultural values representing a wider spectrum, similar in range to the variety in the missing middle. Conceptually, middle class financial success is measured by the individual’s ability to comfortably support his own life, whatever it entails.

2020 is forward-looking at a very different future than 1998. Its a time to consider fresh approaches, or a return to earlier ones. With fiat money being the current global currency of governments, central management and the wealth redistribution economy are here to stay, at least for a time being. Large systems cannot be changed abruptly, without causing mass disruption. They require an awareness of incremental change and a conscious vision of where we are going.